Moreover, it helps us to prepare an income statement for each product, segment, region, and so on. It will help the management to access each category’s performance across the whole company. They can boost the performance of the most profitable and shut down the low performance. AdvantagesThe focus on economic profit rather than accounting profit makes EVATM better aligned to companies’ objectives of maximising shareholder wealth.

How does ABC influence pricing strategy?

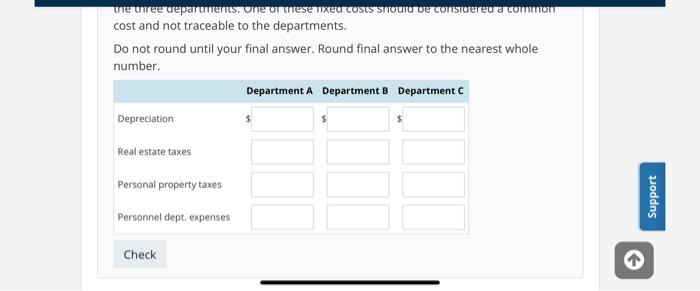

Recognising the share of head office costs is important though in order to reflect the costs the division would have to incur if it were independent. If divisional performance is assessed on only traceable profit it is likely to be overstated compared to an external competitor. If the division were a separate company, it would have to incur some of the corporate traceable cost costs itself (for example, HR, IT, finance costs, which are incurred by head office within a group structure). As such, a company should use divisional profit to compare the performance of one of its divisions to that of an external company. The table shows that the total cost of product A is $81,833 and the total cost of Product B is $133,167.

Why Some Businesses Choose Traditional Costing Over ABC

- ABC Analysis stands as a cornerstone in the edifice of inventory management, offering a systematic…

- As such, using ROI and RI as performance measures could encourage dysfunctional decision-making, rather than promoting goal congruence (one of the key characteristics of effective performance measures).

- In this case, managerial accounting staff would likely allocate a portion of the security worker’s salary to each computer.

- If it’s impossible or too time-consuming to quantify the exact amount, these costs are untraceable and are indirect costs.

- This helps in identifying areas of inefficiency or excessive spending, enabling organizations to take corrective measures and optimize their resource allocation.

- When ABC is woven into a business’s accounting process, it directly affects product pricing.

In practice, investment centres are often only charged the debt portion of corporate capital, which understates the true cost of the centre’s capital. ROCE should be greater than the cost of capital for a company to be profitable over the long-term. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Which activity is most important to you during retirement?

Examples include the salaries of corporate executives or the utilities for a factory that produces multiple products. Allocating these costs to specific products or departments often requires estimations or the use of allocation bases. Once you have defined your objectives, scope, cost drivers, cost objects, and cost allocation and attribution methods, you need to implement your cost traceability system. This involves collecting, processing, storing, and analyzing the cost data from various sources and systems. You need to ensure that your cost traceability system is reliable, consistent, and scalable.

Traceable Costs Can Become Common Costs

For example, marketing fees relating to the division but agreed by the Head Office marketing director (not the divisional manager) are traceable, not controllable. Similarly, legal fees or audit fees relating to the division but agreed by head office. However, small businesses face scarcities in resources due to different limitations—such as financial capabilities, difficulty in accessing materials, and other external factors. On the other hand, traceable fixed costs are incurred as a common denominator, irrespective of different departments existing within the company. These are the costs that are incurred regardless of different operations existing within the business domain.

Cost traceability analysis can also help regulators to enforce the standards and regulations that govern the business process or the product and protect the public interest. This can help the regulator to verify the accuracy and completeness of the waste reporting, to impose the appropriate taxes and fines on the waste producer, and to encourage the waste reduction and recycling. Direct costs are a cost that can be easily traced to a specific product or service while indirect costs cannot be easily traced. Understanding your main products is the key to knowing which costs can be conveniently computed and measured. If it’s impossible or too time-consuming to quantify the exact amount, these costs are untraceable and are indirect costs. The goal is to get a complete view that enables companies to assess everything from the customer and channel mix to the profitability of products and SKUs.

For example, a cost driver could be the number of hours worked by an employee, and a cost object could be a product or a service. You need to identify and classify your cost drivers and cost objects according to their relevance, importance, and availability. You also need to determine the level of detail and granularity you want to capture and report for your cost drivers and cost objects. It is important to note that these factors interact with each other, and their impact on cost variations can vary across industries and businesses.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

By expanding the number of cost pools and creating new bases for overhead allocation, this highly effective methodology revolutionizes the way we analyze indirect costs and understand where our resources are spent. This transformation promotes improved decision-making in cost control, resource allocation, and pricing strategy, all of which contribute to the overall financial well-being of an organization. In conclusion, cost calculation in ABC is vital for achieving a more accurate representation of overhead costs related to producing or providing specific products or services. By identifying necessary expenditures, grouping them into appropriate cost pools, and determining cost driver rates, businesses can make better financial decisions and improve profitability.

Traceable profit should exclude overhead costs which are incurred centrally and then re-apportioned to a division. These costs are provided by head office for the benefit of multiple divisions, rather than relating directly to one division (eg central marketing services, HR, IT or finance). From an operational standpoint, mapping cost flows helps organizations identify bottlenecks or inefficiencies in their processes. By visualizing the flow of costs, organizations can pinpoint areas where resources are being underutilized or wasted. This insight allows for process optimization, streamlining operations, and reducing unnecessary expenses. The division manager or department manager will typically not have control over indirect costs.